5 Reasons Why Today’s Brands Are Making Customer Retention a Priority

Customer retention is a priority for many companies right now. This is because it’s easier to sell to existing customers than it is to go out and find new ones. And while there may be no shortage of companies in your market, loyal customers are more valuable than new ones. In this artice we’ll cover five reasons why customer retention is important for today’s brands.

There is no shortage of companies in your market

There is no shortage of companies in your market. There are more companies than ever before. With so much competition and a growing need for customer retention, it’s important to keep people coming back by staying ahead of the curve. But how do you do that? By being better at what you do than anyone else.

In today’s marketplace customers are more loyal to brands they have been buying from for a long time. As a result, businesses must focus on building relationships with their customers and ensuring that they feel valued as individuals rather than just another number on an invoice. After all, loyalty can be earned— but only if brands are willing to put in the work.

Loyal customers are more valuable than new ones

Whether you’re a business-to-consumer (B2C) or business-to-business (B2B) company, it’s important to understand the value of your existing customers. Loyal customers are more likely to buy more often, buy more expensive items, and are less price sensitive as compared with non-loyal customers. Loyal customers are also less likely to shop around and will recommend your brand to others.

It is easier to sell to existing customers

It is easier to sell to existing customers than it is to find new ones. Customer retention not only helps boost marketing efforts but also sales strategies because your company has already invested in creating the right infrastructure and employee training that will help retain customers.

Customer acquisition costs are increasing

As competition in the marketplace increases, the cost to acquire new customers is also increasing. Many companies today are allocating more of their marketing budgets to advertising and word-of-mouth campaigns. Unfortunately, the price of advertising is only rising, making it difficult for businesses to build a strong customer base without spending more money than they can afford on acquiring new customers. This means that companies need to find ways of retaining current customers because it’s becoming increasingly expensive for them just to get new ones.

The rise in competition has also led many companies to focus on acquiring new customers instead of retaining existing ones—but today’s savvy brand managers know better than this. They understand that investing in customer retention strategies will always be cheaper than acquiring new ones. After all, you can build up trust with existing clients through timely interactions over time (like sending out newsletters), rather than having one shot at convincing someone who doesn’t know much about your brand yet (such as running an ad campaign).

It is more profitable

The revenue from existing customers is far more predictable than from new ones. It’s also easier to keep track of and measure. This is because it takes less time and resources to retain an existing customer than it does to acquire one through advertising, marketing, or other promotional activities.

Conclusion

For all of these reasons, it is no wonder that customer retention is on the rise. But as you have seen, this does not mean you should ignore customer acquisition. It’s important to pursue both channels of growth because they complement each other and help your business thrive in different ways. If you want to get ahead of the competition, consider implementing a customer retention strategy for your organization today.

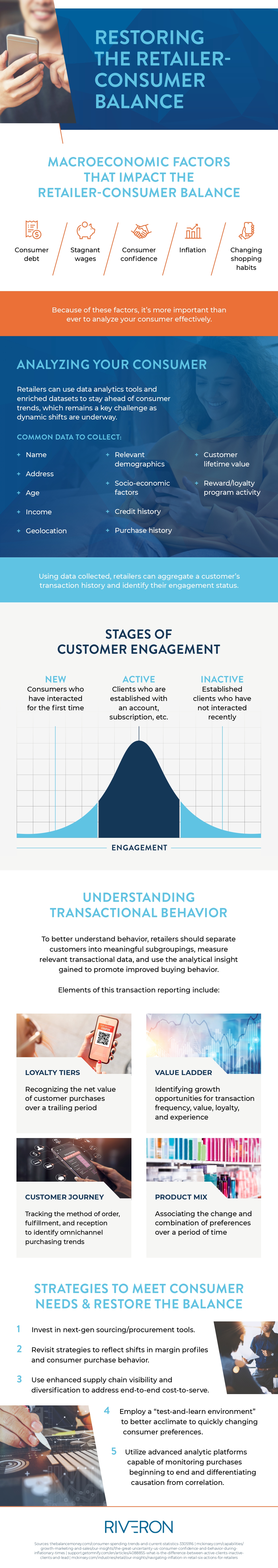

As brands look to retain customers and improve sales, understanding consumer data is important in making informed decisions. Please see the resource below for some help understanding how to restore the retailer-consumer balance.

Infographic provided by Riveron – accounting advisory professionals