The Importance of Small Business Financial Intelligence for Long Term Success

Attention all entrepreneurs! Are you tired of feeling overwhelmed and frustrated with your finances? Do you wish you had a better understanding of how to manage your money effectively? Start focusing on expanding your small business financial intelligence.

In today’s competitive market, having a solid grasp on financial management is crucial for the success and sustainability of your small business. Join us as we dive into why small business financial intelligence is so important, how it can benefit your enterprise, and tips for improving yours. Get ready to take control of your finances and watch your business thrive!

What is Small Business Financial Intelligence?

Small business financial intelligence is the ability to understand and use financial information to make sound business decisions. It involves using data to assess opportunities and risks, make informed choices about where to allocate resources, and track progress towards financial goals.

Small business financial intelligence gives entrepreneurs the valuable tools for making decisions that can help their operations grow and succeed. With FI, owners can identify areas where they may be overspending or underspending, as well as potential opportunities for revenue growth. Additionally, financial intelligence can help owners track their progress towards key financial goals, such as profitability or cash flow targets.

While financial intelligence is critical for all businesses, it is especially important for small businesses. This is because small businesses often have limited resources and must carefully manage their finances to ensure long term viability. With financial intelligence, small business owners can make informed decisions that will help them use their resources effectively and improve their chances of success.

The Benefits of Having Financial Intelligence for Small Business Owners

As a small business owner, financial intelligence can give you a serious competitive edge.

1. Improved decision making:

When you have a good grasp of your finances, you can make better decisions about where to invest your time and money. You’ll know what’s working and what isn’t, and you can adjust your strategy accordingly.

2. Increased profits:

With better decision making comes increased profits. When you know where to invest your resources, you can create a more efficient and effective business operation.

3. Greater peace of mind:

When you’re in control of your finances, you’ll have greater peace of mind knowing that your business is on solid footing. This can free up mental space to focus on other aspects of running your business.

4. Reduced stress:

Along with increased peace of mind comes reduced stress. Worrying about money is one of the most common sources of stress for small business owners. But when you have a handle on your finances, that worry will dissipate.

5. More time to focus on other things:

When you don’t have to spend as much time worrying about money, you can focus on other important things like growing your business or spending time with loved ones.

Financial intelligence is essential for small business owners, and the benefits are clear. When you have a good understanding of your finances, you can make informed decisions about where to invest your resources and how to grow your business. You’ll also experience greater peace of mind and less stress, freeing up more time to focus on other things.

What Does Financial Intelligence Entail?

Small business financial intelligence is the ability to understand and use financial information to make sound business decisions. It includes an understanding of financial statements, cash flow, and other financial metrics, as well as an awareness of the economic environment in which your business operates.

Financial intelligence is critical for small business success because it allows you to make informed decisions about where to allocate your limited resources. It also helps you anticipate and manage financial risks. Without a strong foundation of financial intelligence, it can be difficult to grow your business and achieve long term success.

How to Develop Financial Intelligence in Your Small Business

One of the most important things you can do for your small business is to develop financial intelligence. This means understanding the numbers behind your business and using them to make informed decisions. There are a few key things you can do to develop financial intelligence in your small business:

1. Understand your financial statements:

Your balance sheet, income statement, and cash flow statement are all important documents that can give you insights into the financial health of your business. Take some time to learn how to read and interpret these statements.

2. Know your key financial ratios:

There are a number of important ratios that can help you assess the financial health of your business. Some of the most important ratios include the debt-to-equity ratio, the current ratio, and the quick ratio.

3. Use financial modelling to forecast future results:

Financial modelling is a powerful tool that can help you predict what might happen in the future based on past data and current trends. This can be helpful in making decisions about investments, pricing, and other strategic decisions.

4. Stay up-to-date on accounting and tax changes:

The world of accounting and taxation is constantly changing. Keep up with the latest changes so you can properly apply them to your business.

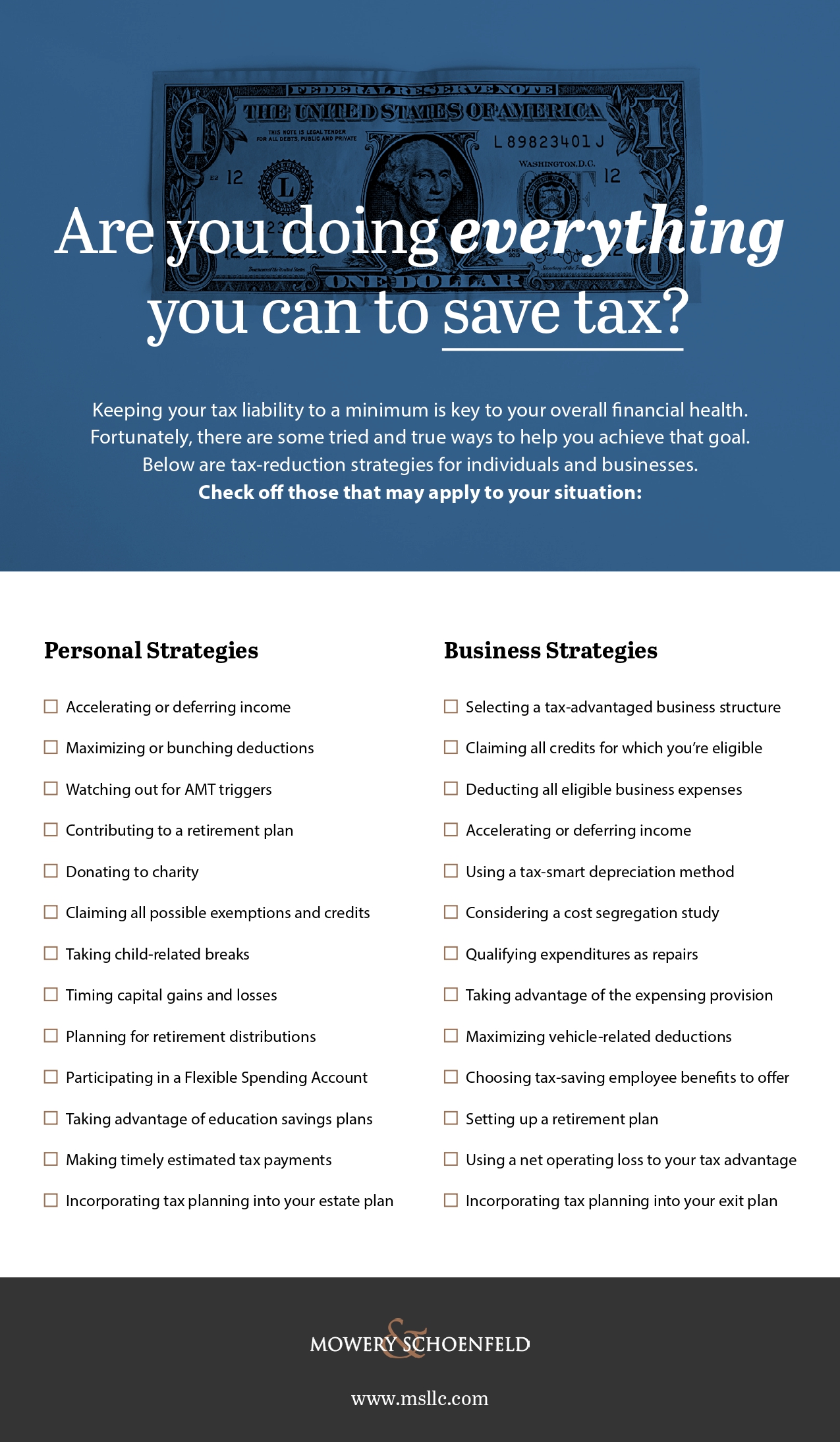

Want to save as much tax money as you can for your business? Check out the infographic below!

Infographic provided by Mowery & Schoenfeld, LLC., a Chicago business tax service provider

5. Hire a good accountant or bookkeeper:

A good accountant or bookkeeper can be worth their weight in gold when it comes to helping you understand and manage your finances effectively. Make sure you hire someone who is qualified and experienced.

By taking the time to develop financial intelligence in your small business, you’ll be better prepared to make sound decisions about your finances. This will lead to increased profitability and a better future for your business.

Once you’ve taken those steps and put your business on the path towards growth, you can then begin to strategize exactly how that growth will take place. Check out the infographic below for tips to expand your business!

Infographic created by Excellere Partners, an entrepreneur investment partner

Common Mistakes Made by Small Business Owners and How to Avoid Them

There are a lot of small business owners out there who make avoidable mistakes that end up costing them money. Here are some of the most common mistakes and how to avoid them:

1. Not knowing your numbers:

The first step to avoiding financial mistakes is to understand your numbers. Know how much money you have coming in and going out, what your margins are, etc. This information will help you make sound decisions about where to allocate your resources.

2. Not having a budget:

A budget is a roadmap for your business finances. It helps you track progress, keep spending in check, and plan for future growth. Without a budget, it’s easy to overspend and get off track.

3. Not separating personal and business finances:

This is a mistake that can lead to big problems down the road. Keep your personal and business finances separate so you can track expenses and income accurately, and avoid commingling funds which can create legal complications.

4. Not staying organised:

Good organisation is key to keeping on top of your finances. Keep records of all income and expenses in one place so you can easily access them when you need to file taxes or make other financial decisions.

5. Not seeking professional help:

If you’re not confident in your own ability to manage your finances, seek out professional help from an accountant or financial advisor. They can provide guidance and peace of mind so you can focus on running your business .

Strategies for Increasing Your Financial Intelligence

There are a number of strategies you can employ to increase your financial intelligence. Below are some suggestions:

1. Read books or attend seminars on the topic:

This is a great way to gain new insights and perspectives on money management.

2. Hire a financial advisor:

A professional can help you better understand your finances and give you personalised advice on how to improve your situation.

3. Keep track of your spending:

Knowing where your money goes each month is an important step in getting a handle on your finances. Try using a budget or tracking app to help you stay mindful of your spending patterns.

4. Make a plan:

Having a clear financial goal in mind will help you make better decisions about how to use your money. Write out your goals and create a budget or investment plan to help you reach them.

5. Get organised:

Organising your financial records will make it easier to track your progress and spot any potential problems along the way. Set up a system for tracking income, expenses, investments, and debts so you can easily see where you stand financially at all times.

6. Invest in yourself:

Investing in your education or professional development can often be a great way to increase your income potential and improve your financial intelligence in the long run.

Parting Words

In conclusion, financial intelligence is a critically important factor that can make or break the success of small businesses. It is essential for owners to understand their business finances and have sound decision making skills in order to ensure long term growth and sustainability. With knowledge about budgeting, accounting principles, and financing options, small business owners can gain an edge over competitors and be better positioned for success.